Herges Capital composes and manages your taxable individual account or your tax-deferred or tax-free rollover retirement account. Common to all Herges Capital investment strategies is the aim to minimize the drag on performance due to third-party management fees, taxes (if applicable), transaction cost and uninvested cash.

Matching Clients’ Risk Preferences

Capital Preservation

That would be a money market and fixed income portfolio only. Expected return is minimal. The main objective is to preserve/park capital meant for later major purchases.

Cautious GrowTH

The portfolio would be a balanced mix of stocks, bonds and commodities. The objective is to allow growth while still aiming to avoid loses.

Moderate Growth

That is predominantly a North American (USA & Canada) stock portfolio and/or commodities. No major exposure to foreign markets means no additional currency risk. For European clients/accounts that would be a Euro-linked stock portfolio and/or commodities.

Aggressive Growth

That is a global stock market portfolio made up of U.S. (single stocks), Canadian (single stocks), European (ETF), Japanese (ETF) and emerging markets stocks (ETF) plus commodities. Currency risk adds volatility, but also provides additional income sources.

Our Expertise

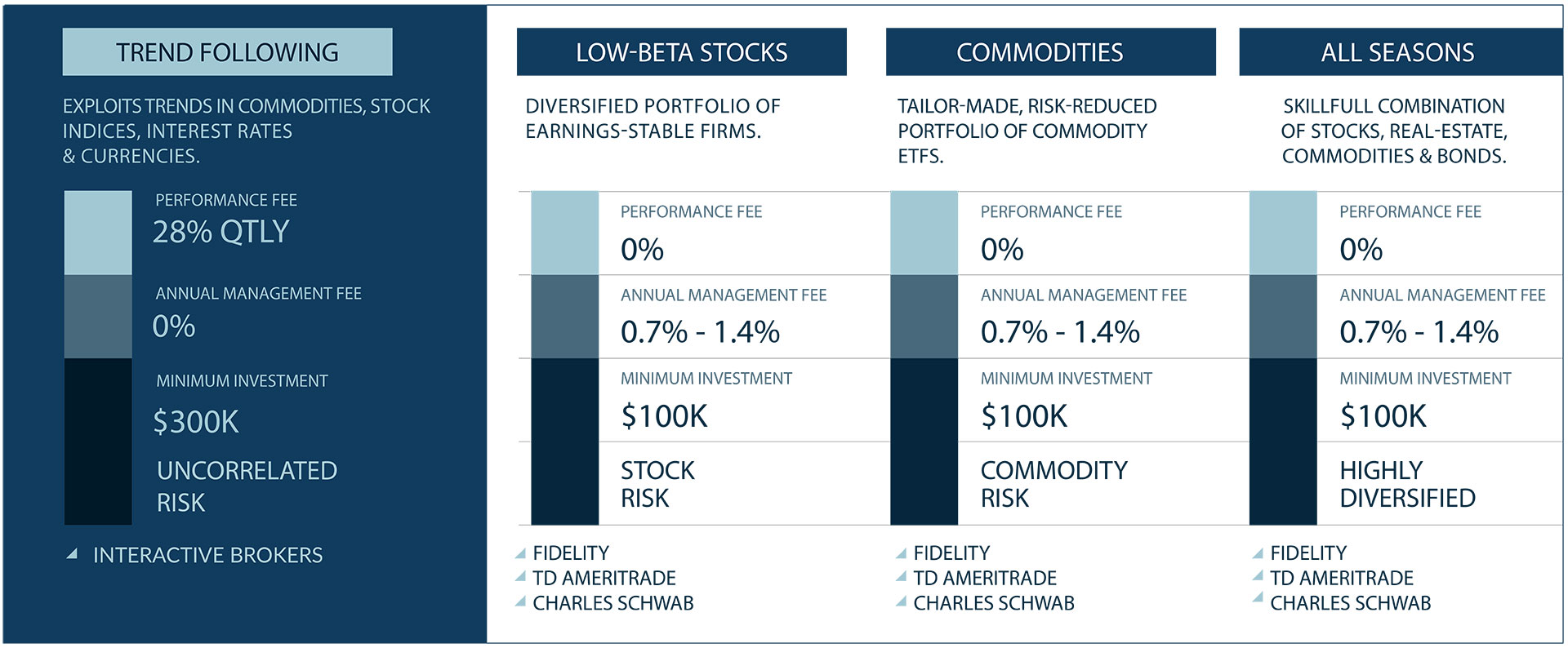

We see our special expertise in direct indexing U.S., Canadian and European stock markets. A direct investment style that avoids altogether mutual funds and ETF fees. A relatively new approach that allows dividends to be received immediately and continuously throughout the year instead of delayed every quarter only. We also developed a novel, risk-adjusted way to invest in commodities. Investor clients may hire us for composing and managing just a specific, narrow asset portfolio, like only Northern American stocks, only European stocks or exclusively commodities. Therefore complementing existing investments with other houses. However, far more popular is the highly diversified ‘All Seasons’ portfolio that would always include the aforementioned components.

Highly unusual for a registered investment advisor, Herges Capital holds also a Commodity Trading Advisor (CTA) license. In that role the firm can directly offer the alternative investment strategy ‘Trend Following’ to high-net-worth individuals.

UDO HERGES, PH.D.

Herges Capital Management LLC was founded by Dr. Udo Herges, who earned his Ph.D. in Applied Mathematics at Brunel University in London, U.K.

Udo participated in the Salomon Brothers Training Program For Business Production in New York City prior to working for Citigroup, the Swedish SEB, and Germany’s second largest bank Commerzbank.

Udo left in the rank of vice president and founded Herges Capital in 2013.

Udo is also an undefeated former U25 German Correspondence Chess Champion, and he is today a chess coach and sponsor in San Diego, California.

Call Udo today for a free consultation. Dedicated to Your Investment and Success,

What is an Investment Advisor?

About

Investment Advice

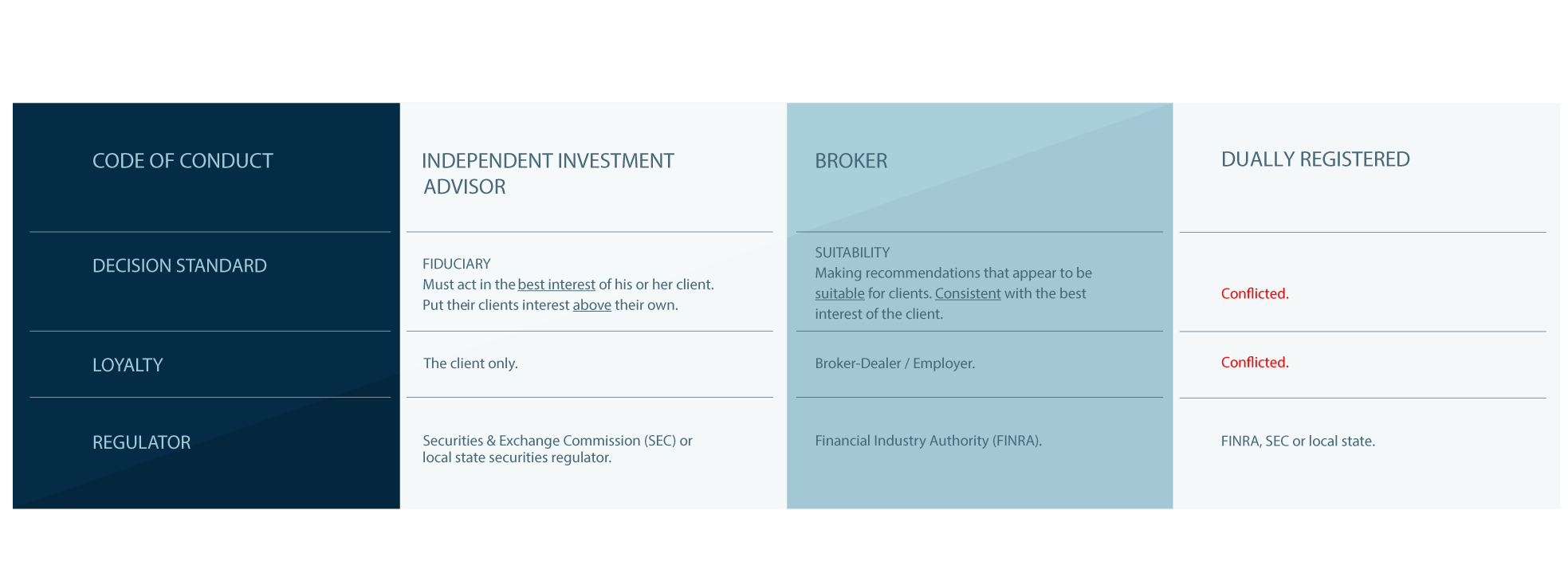

It is paramount knowing with whom exactly you speak about your investment activities. There are three types of financial advisors:

a) Brokers work for broker dealers or insurances. They earn commissions on the products they aim to sell to you. When doing so they are not required to have your best interest in mind. Brokers are only subject to a suitability standard. Their ultimate loyalty is to their employer and the profitability of those institutions.

b) In contrast, Registered Investment Advisors (RIA) are by federal law obliged to act in your best interest only. They are bound to the highest, the so-called fiduciary standard.

c) Some firms are dually registered as RIA and broker. While they might have the best intentions, the problem is you never know in which role they advise you at that very moment. At any time those professionals are possibly conflicted between your best interests and their potential commission. Those financial advisors are therefore to be avoided.

There is absolutely no reason to entrust your hard-earned money to a broker when instead you can work with a non-conflicted investment advisor. Only 8% of all financial advisors are independent investment advisors, not being simultaneously a broker or linked to one. Herges Capital belongs to that rare group.

A highly-recommendable book deals with that topic in chapter 5 ‘Who can you really trust?’ in ‘Unshakeable’ by Tony Robbins.

15 Years Of Experience

State Registered

Investment Advisor

FIDUCIARY NOT

a Broker

Investment

Strategy Overview

Assessing the client’s status quo, risk preference, investment horizon, location and goals Herges Capital composes an overall tailor-made portfolio out of various investment blocks. Those investment blocks are stocks, fixed-income bonds, inflation-protected bonds, floaters, REITs, commodities, trend following and more. Just like various pieces on a chess board are moved harmonically over time to follow one strategic goal.

Contact us for a free Consultation

Often an initial step for investors is to trustfully forward their latest broker’s statement for us to comment on. Common are also requests to recommend funds out of a 401k program. In both cases fees and sufficient diversification guides our reply.