Herges Capital strives to support you in every aspect of your financial live. May that be optimal tax-savings, retirement planning or kids’ education funding. Ultimately, investment allocations will have to correspond to and adapt to your personal life situation and goals.

About

Wealth Management

Taxes do have significant net return implications. It is important to apply an active, forward-looking tax minimizing investment strategy. Tactical asset allocation between taxable and non-taxable accounts (if both exit) can be optimized. The classical choice between traditional or Roth IRA is dependent on prospective taxes.

How much to put aside for what style of retirement? Whether you are still in the accumulation phase or already retired, it is always insightful and motivating to have a meaningful projection. So to possibly correct spending or saving.

Investment

Strategy Overview

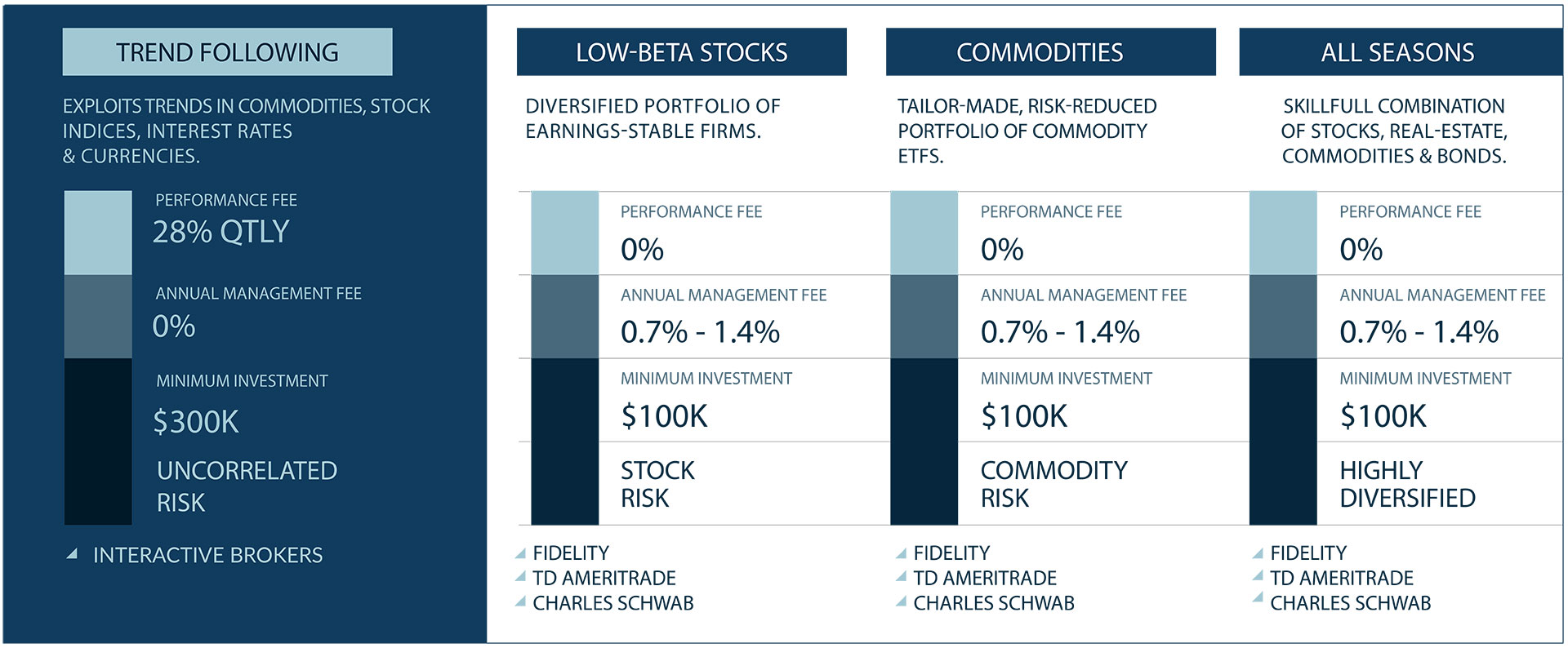

Assessing the client’s status quo, risk preference, investment horizon, location and goals Herges Capital composes an overall tailor-made portfolio out of various investment blocks. Those investment blocks are stocks, fixed-income bonds, inflation-protected bonds, floaters, REITs, commodities, trend following and more. Just like various pieces on a chess board are moved harmonically over time to follow one strategic goal.

Matching Clients’ Risk Preferences

Capital Preservation

That would be a money market and fixed income portfolio only. Expected return is minimal. The main objective is to preserve/park capital meant for later major purchases.

Cautious GrowTH

The portfolio would be a balanced mix of stocks, bonds and commodities. The objective is to allow growth while still aiming to avoid loses.

Moderate Growth

That is predominantly a North American (USA & Canada) stock portfolio and/or commodities. No major exposure to foreign markets means no additional currency risk. For European clients/accounts that would be a Euro-linked stock portfolio and/or commodities.

Aggressive Growth

That is a global stock market portfolio made up of U.S. (single stocks), Canadian (single stocks), European (ETF), Japanese (ETF) and emerging markets stocks (ETF) plus commodities. Currency risk adds volatility, but also provides additional income sources.

Our Expertise

We see our special expertise in direct indexing U.S., Canadian and European stock markets. A direct investment style that avoids altogether mutual funds and ETF fees. A relatively new approach that allows dividends to be received immediately and continuously throughout the year instead of delayed every quarter only. We also developed a novel, risk-adjusted way to invest in commodities. Investor clients may hire us for composing and managing just a specific, narrow asset portfolio, like only Northern American stocks, only European stocks or exclusively commodities. Therefore complementing existing investments with other houses. However, far more popular is the highly diversified ‘All Seasons’ portfolio that would always include the aforementioned components.

Highly unusual for a registered investment advisor, Herges Capital holds also a Commodity Trading Advisor (CTA) license. In that role the firm can directly offer the alternative investment strategy ‘Trend Following’ to high-net-worth individuals.

Contact us for a free Consultation

Often an initial step for investors is to trustfully forward their latest broker’s statement for us to comment on. Common are also requests to recommend funds out of a 401k program. In both cases fees and sufficient diversification guides our reply.